Build Real-World Trading Skills with Structured Guidance

No hype. No nonsense. Just structured, evidence-based trading education built for serious learners of the Indian markets.

Arun BauMentor

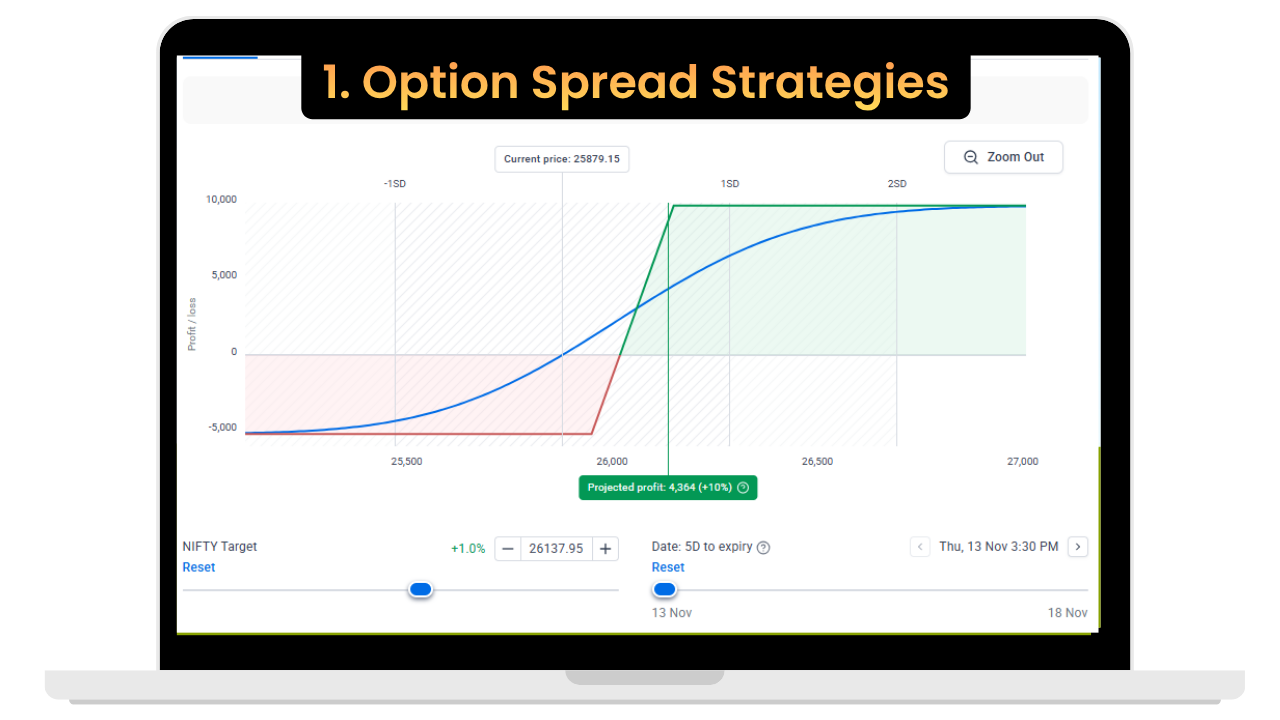

Options Trading Courses

Build your trading skills through focused, evidence-based options trading courses

Master the complete Options Trading framework with all five segments - or choose individual segment-specific modules to learn at your own pace.

Complete Bundle (5 Segments)

Segment-Specific Courses

Who Benefits from Our Courses

Starting from Zero

Never traded before? Learn the fundamentals without the confusion. Structured, step-by-step.

Working a 9-to-5

Build a second income stream without quitting your job. Trade around your schedule.

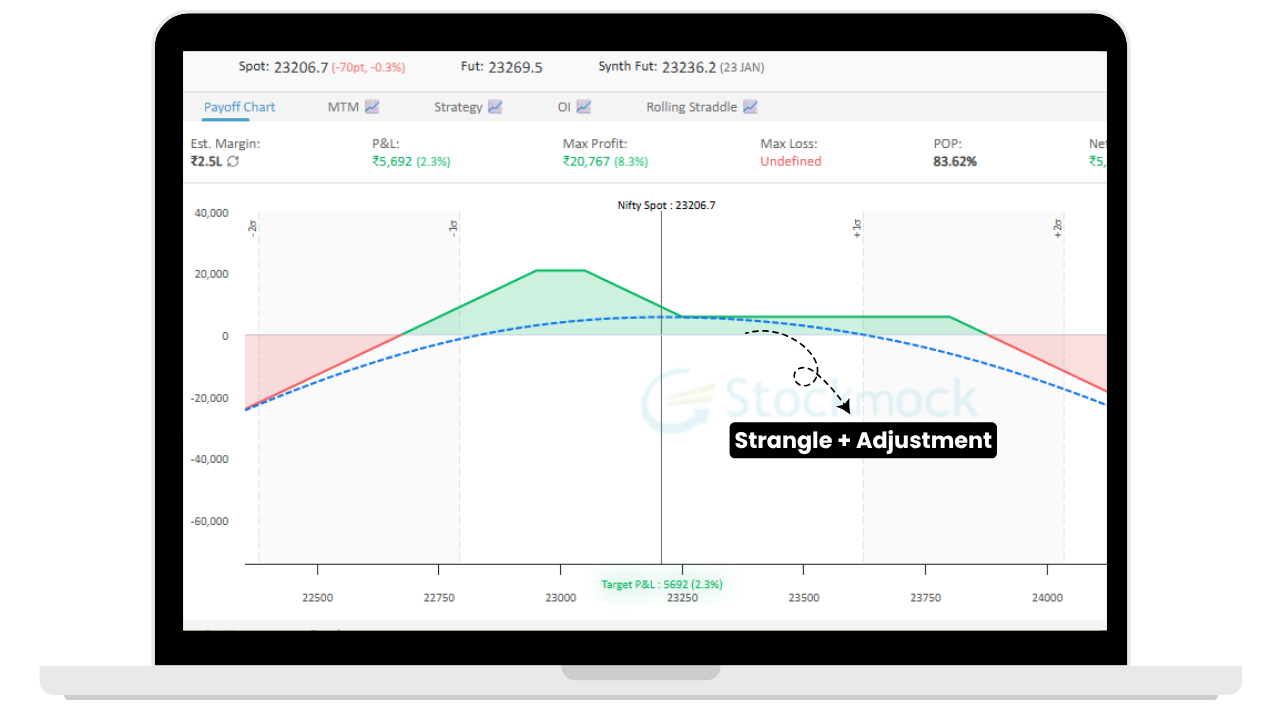

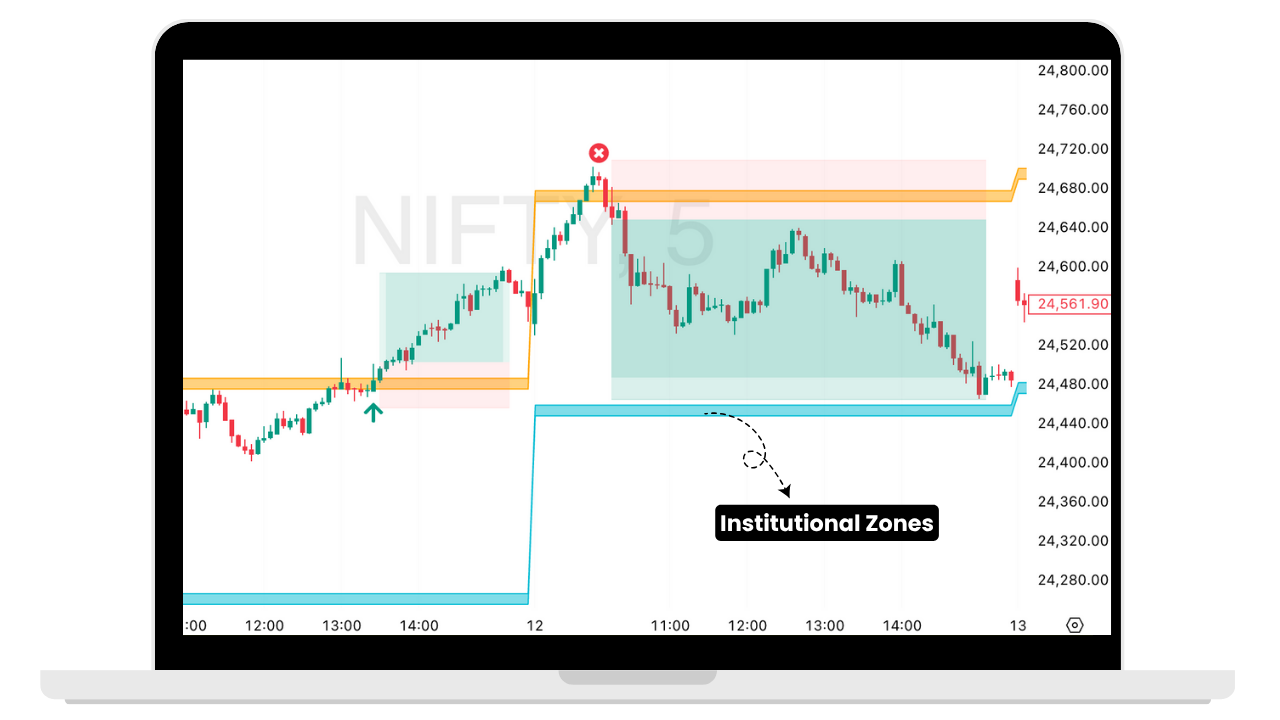

Already Trading (But Inconsistent)

Refine your strategy with Price Action, SMC, and proper risk management. Move from random to consistent.

Done with YouTube Chaos

Tired of scattered tips and conflicting advice? Get everything you need in one structured program.

Want Trading as Your Career

Ready to go full-time? Learn what it actually takes. Systems, discipline, and real market understanding.

Here for Quick Money? Wrong Place.

This is for people building real skill, not chasing shortcuts. If that's you, don't join.

Why Learn with Mindfluential Trading

Structured Learning

Step-by-step curriculum

On-Demand Learning

Self-paced & flexible

5+ Year Mentor-Led

CA & CFA Level 3 guidance

Free Updates

As long as course access

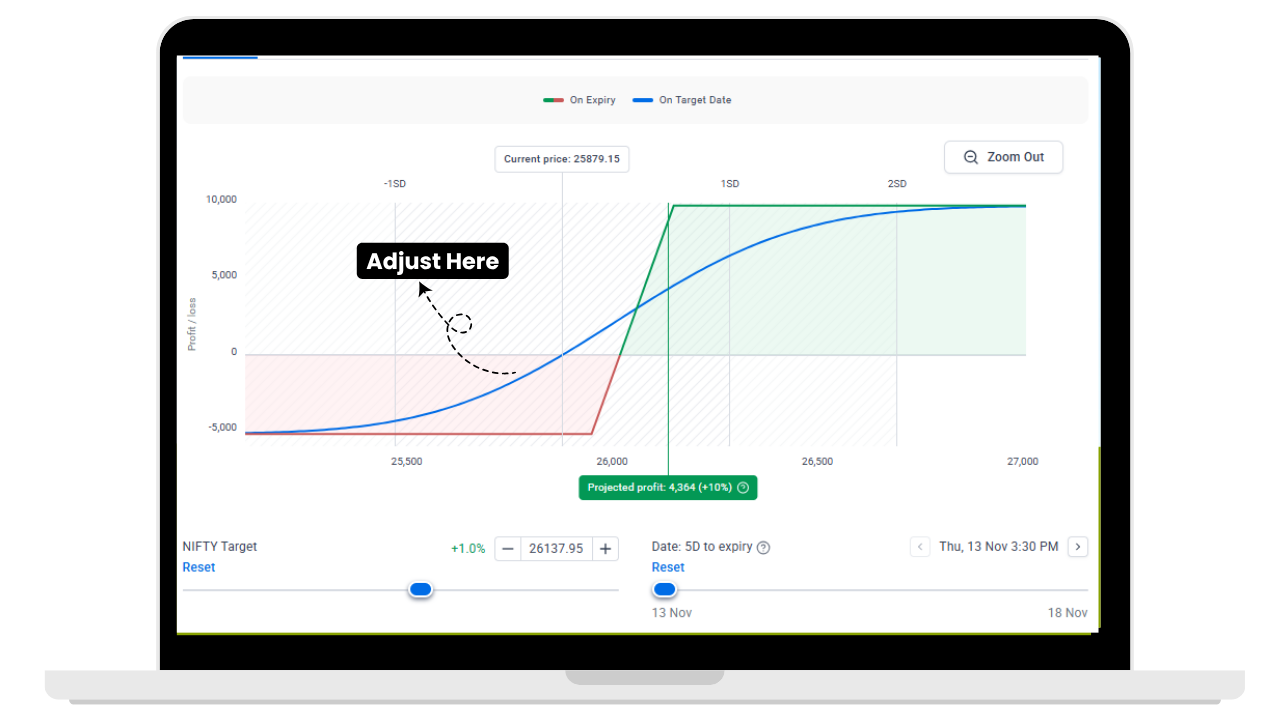

Practical Focus

Built for real trading

500+ Reviews

Trusted by serious learners

What Our Students Say

Real experiences from traders who've transformed their journey with our courses

"You took my understanding on price action to a whole new level. The course covered everything that you need to know to stand in the markets. I am grateful to the internet that I found this program and attended it. Would recommend anyone that is lagging confidence in trading you should definitely join the program."

Nikhil Dwivedi

Enrolled in Cash & Futures Mastery

I already have 3 master's degrees, but this one is the best course I've done.

Col. Pankaj Geetey

Meet Your Mentor

Arun Bau

I'm a Chartered Accountant and CFA Level 3 cleared professional with over 5 years of experience in Indian stock and F&O markets.

I've mentored 6,000+ traders across India, focusing on practical, strategy-driven learning. After years of trading, I'm here to share real insights—not motivational talks or get-rich-quick schemes. Just proven strategies, systems, and the discipline to use them.

My approach is straightforward: teach what works in real markets. Structured strategies, disciplined execution, and the right mindset to handle both wins and losses. No hype, no shortcuts - just practical knowledge built for consistent trading.

If you're here to learn trading properly, with structure and clarity, you're in the right place.

Frequently Asked Questions

Everything you need to know before getting started

Do I need prior trading experience?

No. Our courses are structured to take you from basics to advanced. If you're starting from zero, we'll build your foundation properly.

Are these courses live or recorded?

All courses are pre-recorded and on-demand. Learn at your own pace, revisit lessons anytime, and fit learning around your schedule.

How is this different from free YouTube content?

YouTube offers scattered information with no structure. Our courses provide step-by-step learning and focused content designed for real market application.

How long do I have access to the course?

Do you provide trading tips or stock recommendations?

Can I trade part-time while working a full-time job?

Can I interact with the mentor or ask questions?

Need Further Support?

Have more questions? Our team is here to help. Message us directly on WhatsApp.

Message us on WhatsApp