Master Options Spread Strategies

Learn Debit Spreads, Credit Spreads & Risk Management

Course on 7+ Strategies for

Nifty | Sensex | Bank Nifty | Fin. Nifty

📚 Newly Added - "Learn β Portfolio Hedging Concepts with Spreads"

What You'll Learn in This Course

Debit & Credit Spreads, Calendar & Ratio Spreads, Hedging Concepts and Risk Management Techniques

This educational course is designed for learners who want to understand low-risk hedged option strategy concepts, suitable for studying all market conditions for weekly and bi-weekly expiries. All content is for educational purposes only.

Student Learning Experiences

See what our students are saying about their learning journey with this educational course

"Learn Strategy Concepts & Understand Adjustment Techniques"

Educational Example: Debit Spread Win Rates

Without Adjustments

After Adjustments

Learn how adjustments can improve outcomes – understand exactly when & how to modify positions. We'll explain the adjustment concepts with actual backtesting examplesto demonstrate theoretical results for educational purposes.

"Learn About Timely Exit Concepts"

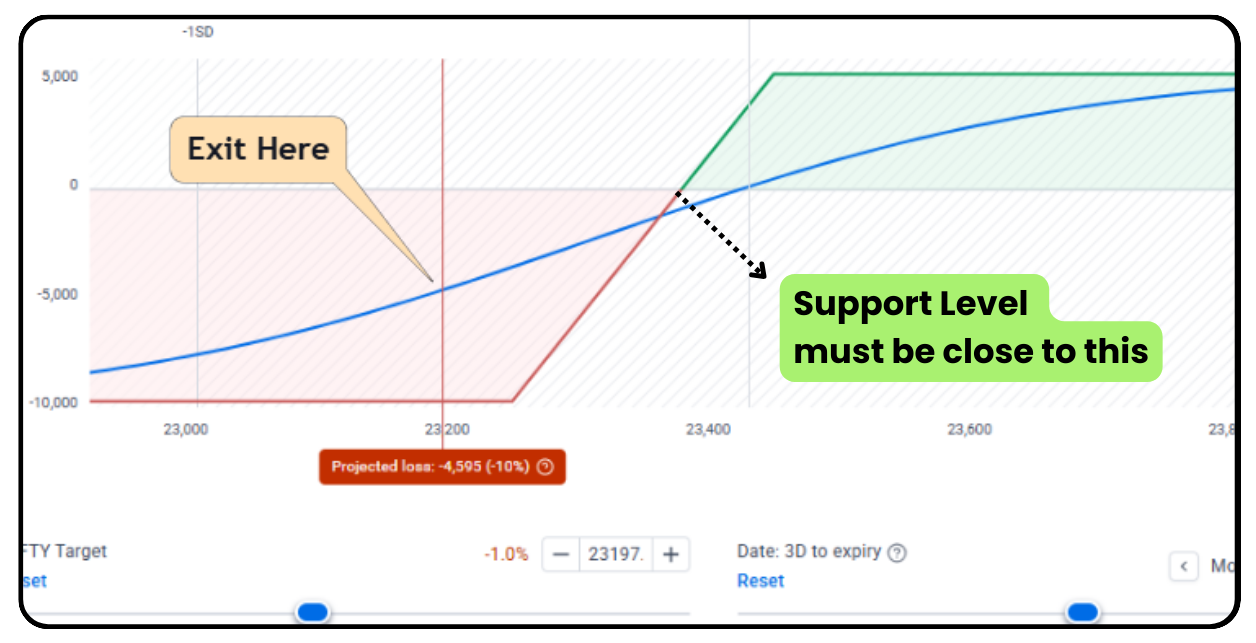

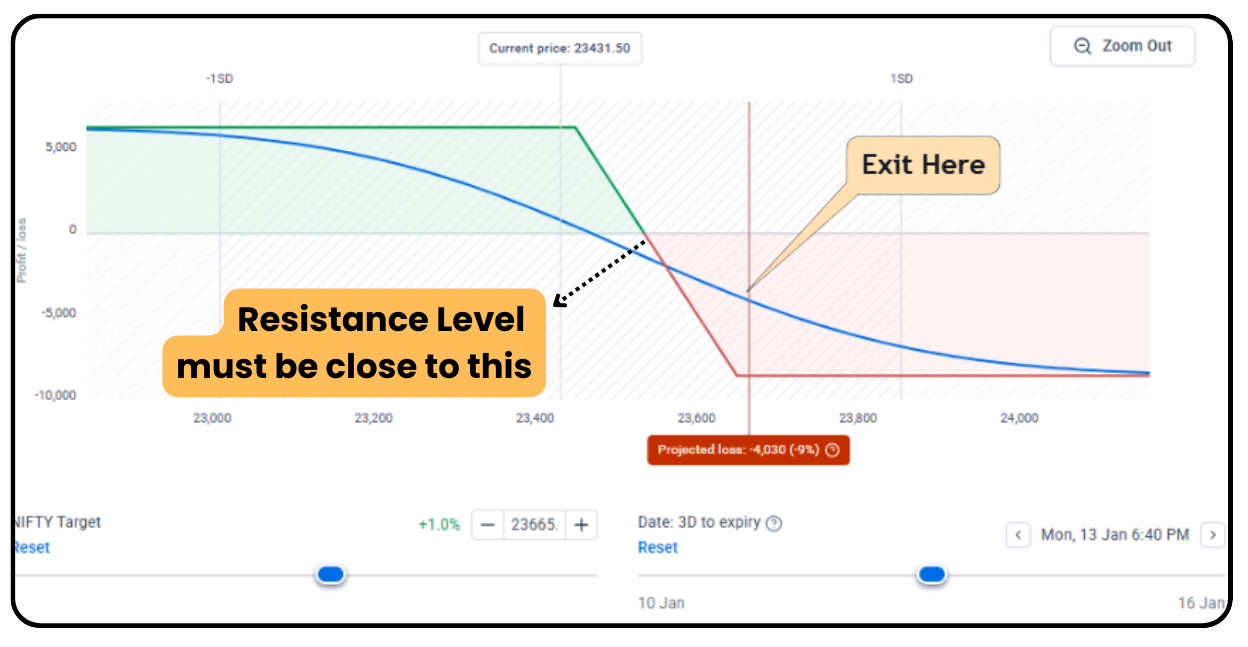

Understand when to exit spreads based on support and resistance level analysis - educational concepts for learning purposes

Support Level Exit Strategy Concepts

Resistance Level Exit Strategy Concepts

"Educational Concept: Not all spreads should be held until expiry."

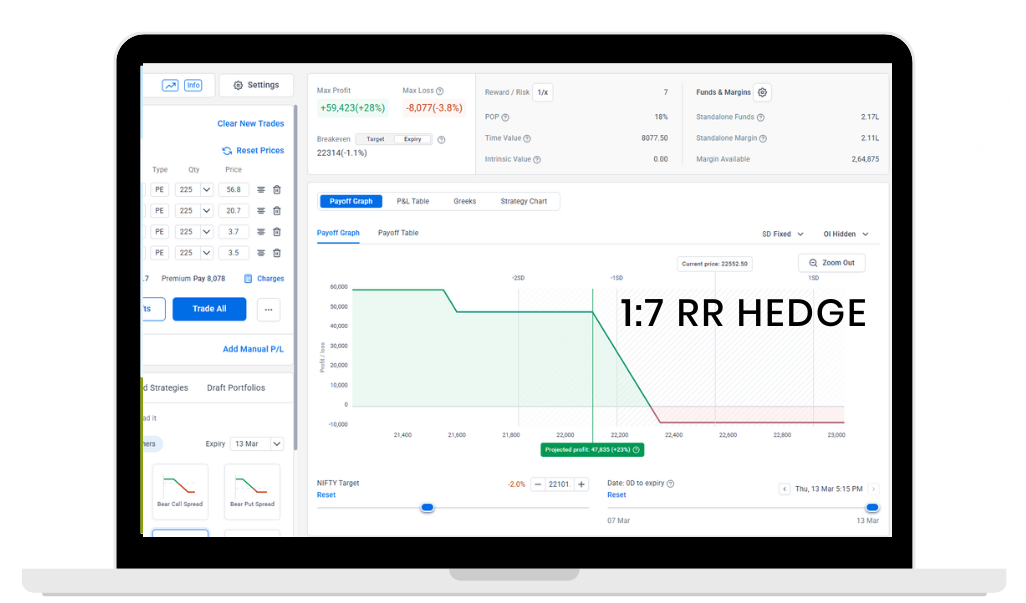

Learn about exit timing concepts and understand reward-to-risk ratio principles. For educational purposes only.

Support & Resistance Analysis

Learn to identify key levels for understanding exit timing concepts

Timing Concepts

Study when to exit before expiry through educational examples

Risk Management Learning

Understand reward-to-risk ratio concepts with strategic exit principles

Course Curriculum

This 4-hour course provides comprehensive learning on spread strategy techniques that can be applied based on market conditions and effective adjustment methods.

Debit Spreads

Learn bull call spreads and bear put spreads for directional trades with limited risk. Understand optimal strike selection, timing, and when to use these strategies in trending markets.

Credit Spreads

Study high probability strategies including bull put spreads and bear call spreads. Learn how to collect premium while managing risk effectively through practical examples.

Ratio & Calendar Spreads

Advanced strategies for volatile market conditions. Learn 4 different ratio spread types and calendar spreads for time decay management. Ideal for understanding sideways market conditions.

Adjustments & Risk Management

Learn techniques to manage trades effectively. Understand when and how to adjust spreads, roll positions, and manage trades that move against you through case studies and examples.

Portfolio Hedging Concepts

Study beta-based portfolio hedging techniques using spreads. Learn theoretical approaches to portfolio protection during market downturns while understanding upside potential.

Timing Strategies

Learn optimal timing for spread deployment. Understand weekly vs monthly expiry dynamics and market cycles to improve your strategy execution.

Capital Management Principles

Study capital allocation principles across different spread strategies. Learn position sizing concepts, margin requirements, and risk exposure management fundamentals.

Risk Management Framework

Complete framework for understanding option spread risks. Learn about stop-loss alternatives, position limits, and capital protection concepts.

What Makes This Course Unique?

Along with time-tested strategy concepts, this course will also teach you how to understand main challenges in options trading through educational examples 📚

Student Learning Feedback

Real feedback from learners who enhanced their options knowledge

"Comprehensive and practical content! The strategies taught are highly actionable and effective."

rajesh_k****

Meet Your Mentor

Arun Bau

CA, CFA Level 3 Cleared

Specializes in systematic option selling strategies with a focus on non-directional approaches. Expert in credit spreads, strangles, and advanced adjustment techniques that help traders generate consistent income from options premiums while managing risk effectively.

Frequently Asked Questions

Everything you need to know about this course

Important Disclaimer

This is a course for learning purposes only. All content should not be considered as trading or investment advice. Please consult a registered financial advisor before making any investment decisions.