Master Non-Directional

Option Selling

– Without Guesswork or Gambling

Learn from Arun Bau, CA and CFA Level 3 cleared, Trader with 5+ years experience in the Indian markets

Consistent 4–5% Returns May Not Sound Exciting –

But That's What the Pros Chase

Not every month will be green. But with the right setup and risk management, non-directional sellers compound slow but sure.

Focus on Consistency

True option sellers focus on consistency, not thrill

Long-term Compounding

They're not chasing 20% a month – they're compounding capital over years

Weekly Returns

Well planned weekly strangle can yield 2 to 3%

Active Management

With proper adjustments, monthly ROI can reach 5-8% with active focus

The Clear Difference

Most Traders

- •Emotional Decisions

- •No Clear Strategy

- •Chase Quick Profits

- •Panic During Losses

Result: Consistent Losses

Pro Sellers

- •Systematic Approach

- •Risk Management

- •Consistent Returns

- •Smart Adjustments

Result: Steady Growth

"Pro option sellers don't brag returns. They stack results."

This masterclass is not for thrill-seekers. It's for serious builders.

Capital Requirements

Currently 1 weekly strangle in indices costs around ₹2.5L. With our expert hedging

"Treat this course as a life skill to grow capital

in a disciplined manner"

Avoid treating options as gambling instruments

Here's What You'll Learn – Step by Step

Phase 1: Understanding Strangle Logic + Filters

Learn the fundamentals of when and how to analyze strangles with proper market filter concepts

Phase 2: Learning Adjustment Concepts

Study the 4 adjustment frameworks: Shifting, Averaging, Extension, and Pyramiding concepts

Phase 3: Understanding ROI Optimization

Learn advanced margin concepts and risk management frameworks

Phase 4: Learning Dynamic Passive Strangle Concepts

Understand systematic strategies with multiple timeframe analysis for educational purposes

4 Things No One Else Teaches This Way

Weekly Expiry Scenarios

(Last 6 Months)

When not to deploy, real trades, no cherry-picking

Expert Margin ROI Hacks

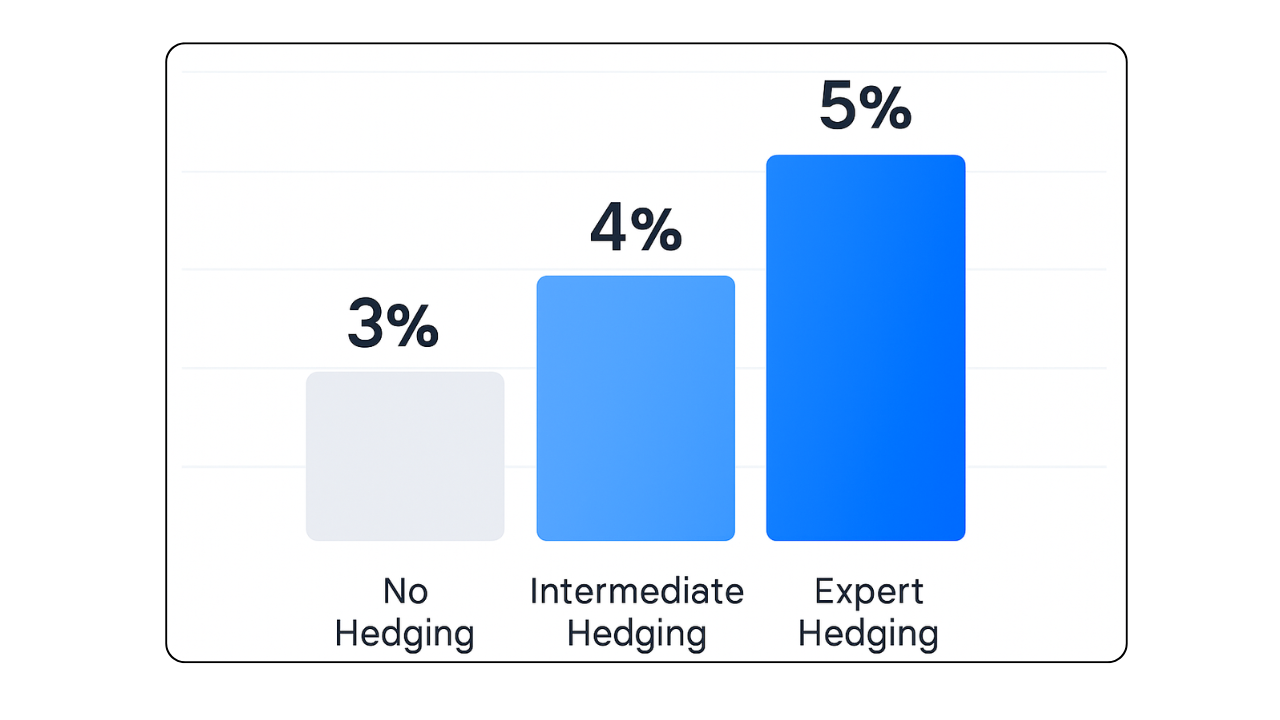

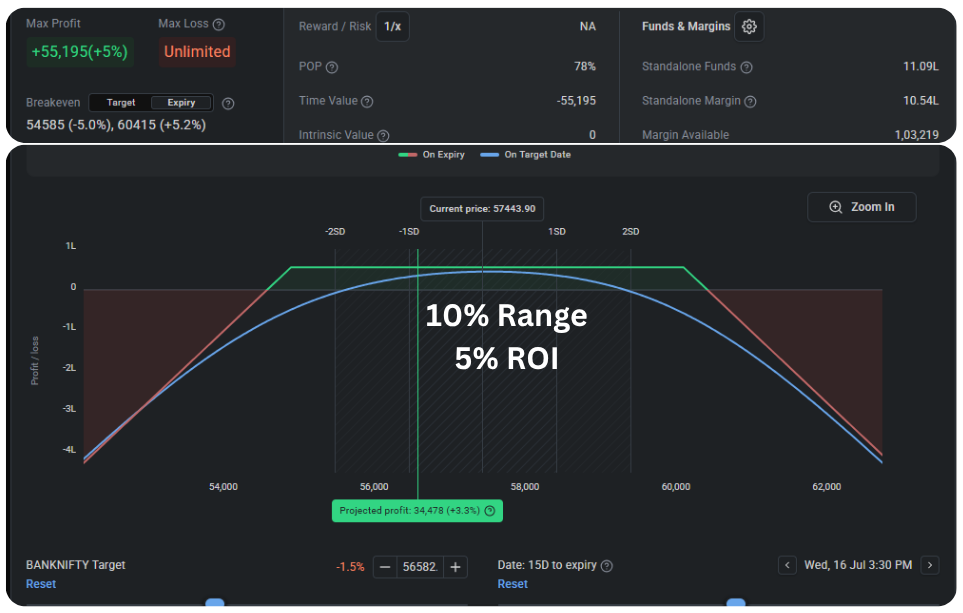

How to increase your ROI by 50% with Expert OTM hedging smartly

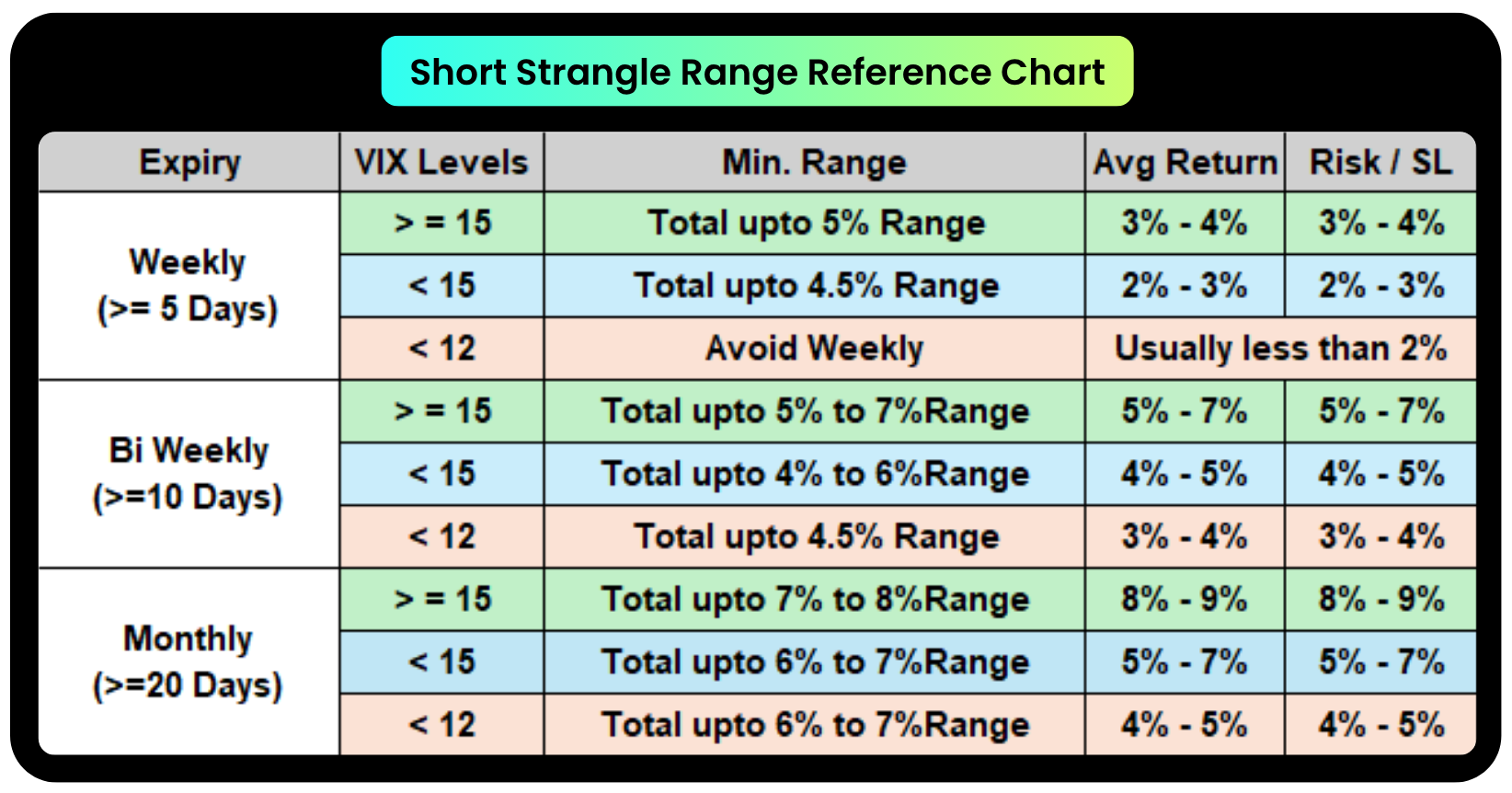

Strangle Range Reference Chart

Know the right range, return, and SL for VIX levels

Monthly Passive Strategy

for Busy Traders

Adjust strangles only when ROI hits 1%, works in low VIX too

Strangle Range Reference Guide for Different VIX Conditions

This comprehensive chart helps you select the right strangle range based on VIX levels and expiry timeframes. Green zones indicate favorable conditions, blue for moderate, and red for avoid conditions.

Meet Your Mentor

Arun Bau

I'm a Chartered Accountant and CFA Level 3 cleared professional with over 5 years of experience in Indian stock and F&O markets.

My approach is straightforward: teach what works in real markets. Structured strategies, disciplined execution, and the right mindset to handle both wins and losses. No hype, no shortcuts - just practical knowledge built for consistent trading.

I've mentored 6,000+ traders across India, focusing on practical, strategy-driven learning. After years of trading, I'm here to share real insights-not motivational talks or get-rich-quick schemes. Just proven strategies, systems, and the discipline to use them.

If you're looking to learn non-directional option selling without confusion or shortcuts, you're in the right place.

What Our Students Say

Real experiences from traders who've transformed their journey with our courses

"Finally understood when NOT to deploy through this course. The VIX-based filter concepts helped me understand market dynamics better."

Rajesh Kumar

Non Directional Selling course student

Trade Like the Big Players – with Clarity and Control

Real Deployment Filters

When to avoid, skip, or shift your strangles

4 Adjustment Systems

Shifting, Averaging, Extension, Pyramiding

Margin ROI Mastery

You can even increase your weekly ROI from 3% to 5% with expert hedging in some weekly strangles

Master Option Selling Now at 40% Off

Get Instant Access Now

(One-time)

Frequently Asked Questions

⚠️Important Educational Disclaimer: This is an educational course only. Trading involves risk. Past results don't guarantee future outcomes.

Enroll in This Course & Learn Systematic Options Concepts